Tax Calculator

Fees (Land Registry):

Note: For the acquisition or construction of new residential buildings, there are specific exemptions regarding Value Added Tax (VAT). If the maximum value of the building does not exceed 350,000 Euro, and the buildable area is at most 130 square meters, a reduced VAT rate of only 5% applies. However, this applies only if the building is initially used for private purposes. The total residential area of the building must not exceed 190 square meters, and the total cost must not exceed 475,000 Euro. If the costs exceed 475,000 Euro or the living area is greater than 190 square meters, a regular VAT rate of 19% is applied. It should be noted that these exemptions are not automatically calculated in the calculator.

Annual Income in Euro:

Fees (Land Registry):

plus 19% VAT on the purchase price.

Privacy Management GroupLtd. regularly checks and updates the information on its websites. Despite all due diligence, it is possible that some facts have changed in the meantime. It is therefore not possible to assume liability or provide any guarantee as to the relevance, completeness or correctness of the information provided. The same applies for all other websites that are accessed through the hyperlinks provided. Privacy Management GroupLtd. is not responsible for the content of websites that are accessed through these links. Furthermore, Privacy Management GroupLtd. reserves the right to make changes or additions to the content provided. In addition to the content and structural copyright protection rights of Privacy Management GroupLtd. websites, the reproduction of information or files, in particular the use of texts, extracts or images, is prohibited without the prior written consent of Privacy Management GroupLtd..

None of the content on any of the Privacy Management GroupLtd. web pages represents an individual recommendation nor is it to be understood as an invitation to trade, default or purchase. Privacy Management GroupLtd. also explicitly points out that you should seek advice from experienced tax consultants and/or lawyers, in particular for any cross-border activities. In principle, any income generated domestically or internationally is subject to taxation. It is solely your responsibility to fulfil your domestic and/or international tax obligations appropriately. Privacy Management GroupLtd. does not accept liability under any circumstance. Additionally, our General Terms & Conditions as well as our Data Protection Provisions and Legal Details apply.

Privacy Management GroupLtd. has the official certification from the Institute of Certified Public Accountants of Cyprus, certification number: E411 / 2013.

Checklist For Relocation

Proforma Invoice

Divident Declaration

UAE Tax Domicile Certificate

Relevant Tax Office Circular

The agreement regarding the automatic exchange of financial informations affects the bank accounts of legal persons, such as offshore companies and other companies registered abroad. Particularly those accounts opened after 31/12/2015. It also affects private bank accounts. The following are extracts of the OECD CRS:

(…) Reportable accounts include accounts held by individuals and entities (which includes trusts and foundations), and the standard includes a requirement to look through passive entities to report on the relevant controlling persons (…)

(…) For Preexisting Entity Accounts a Reporting Financial Institution determine whether the account is held by, (a) one or more Reportable Persons, which can be determined by reviewing information maintained for regulatory or customer relationship purposes (including information collected pursuant to AML/KYC Procedures), or (b) a Passive NFE with one or more Controlling Persons who are Reportable Persons (according to subparagraphs D(2)(a) through (c)) (…)

In short, this agreement makes it mandatory for European financial institutions to pass on all account information necessary for tax purposes to the relevant authorities.

The life of the Digital Nomad definitely comes with amazing advantages. The flexibility to roam the world, meet new people and discover new cultures, travel with the sun and never again suffer another dreary Winter - yes, the life of the Digital Nomad is a dream come true for many. And those who also manage to legally live completely tax-free, have truly found paradise on Earth.

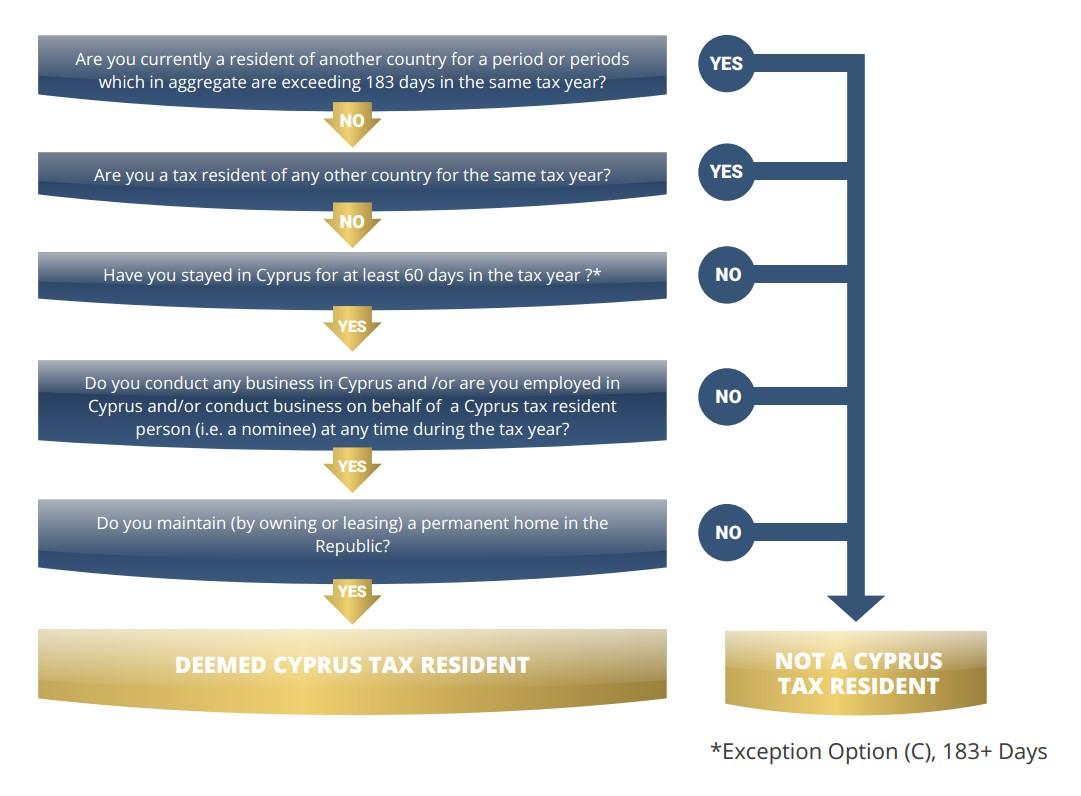

In legal and tax terms, where a person holds their "residence" is dependent on several circumstances, which together give the impression that the person is not only temporarily staying in a particular place. One of these circumstances is if a person spends more than 6 months at a time in one place - the 183 Day Rule. Short interruptions are of no consequence.

Note: Those who exceed this period of 6 months, but are only in a particular location due to health reasons, are not usually considered to have their "residence" there. In such cases, the time period is extended to 12 months. Please also note that the 183 Day Rule is based on "uninterrupted" stays. If you leave the place in question for several substantial periods of time each year, it will not qualify as a residence. Even if you reside in a country for 200 days per year, but are travelling for significant periods in between, that country will not qualify as your residence.

Since July 16, 2015, a non-national residing in Cyprus as part of the Non-Dom Programme is not subject to the so-called SDC tax in Cyprus.

Income from dividends, whether from foreign or domestic sources, is exempt from tax for 17 years. This means that individuals living in Cyprus with the Non-Dom status pay 0.00% taxes on their dividende income.

Relocating to Cyprus (EU) is comparably unproblematic and can be arranged within weeks.

To register in Cyprus you will need:

You can fulfill this last requirement by setting up a company in Cyprus and employing yourself.

Further advantages of setting up a company in Cyprus:

Note:

Should you, for whatever reason, wish to pay yourself a higher wage as director of the company, income tax in Cyprus is more favourable than many other European countries. The highest income tax bracket in Cyprus is only taxed at 35% for yearly earnings above € 60,000.00. For those with Non-Dom status, income tax is halved to 17.5% for the first five years (for earnings exceeding € 100,000.00 annually).

There are several myths about the 183 Day Rule which we would like to clear up.

You have relocated your residence abroad with the plan to exclusively pay taxes in your new home. But it is not just you who is happy about the move, your new home country is happy too:

- because every new resident means a little bit more international political influence,

- for EU member states it might even mean more access to EU funding,

- more taxable income, more VAT, more companies to tax, etc.),

- more consumers and therefore more tax to be collected fromt he national economy,

- more demand in the real estate market, etc..

This is the reason why especially smaller countries welcome immigrants with open arms, luring them with low income tax, Non-Dom Programmes, or other tax benefits.

Both in practice, and in theory, it is therefore unlikely that such a country would actually count the number of days that its new recruits have actually spent in the country.

Even in countries such as Germany, Austria and Switzerland there are ways in which you can declare residency there without spending the necessary 6 months in the country.

Payment of social insurance contributions, a tax file number and social security number, ownership of an apartment or house for private residential purposes, the regular consumption of electricity and waterg, a vehicle and other documents can amount to sufficient evidence of a usual place of residence.

On top of this the usual place of residence can also be determined from other circumstance. Evn school-age children and/or a spouse living under the same roof can provide a clearer picture.

We have already highlighted that simply deregistering from your "old" home country does not necessarily mean that you are freed from all your tax obligations there. We recommend that you reach out to a lawyer and/or tax consultant in your "old" home country with any questions you have about the domestic tax situation there. The tax regulations governing emigrated nationals differs from country to country and we cannot provide you sufficient expertise and support in this area.

While we endeavour to ensure that you receive the necessary support abroad, questions related to emigrating from your "old" home country are a matter to be discussed with a domestic expert.

If you have not yet acquired the services of an accredited lawyer or tax consultant, we are happy to make recommendations.

Another myth about the 183 Day Rule is that it is applied globally. This has been remarked in many online portals, but is definitely "fake news".

One example to counter this myth are the United Arab Emirates. The rule there is that, your resident visa can only be declared invalid, if you have spent more than 6 months, in one stretch, outside the UAE.

So, be critical with what you read on the internet, especially regarding sweeping statements like this one - indeed, where there is a rule, there is most certainly also an exception.

The Republic of Cyprus is a member of the United Nations (UN), the Council of Europe, the Organisation for Security and Cooperation in Europe (OSCE) and the World Bank (WB).

In 1974 Turkey carried out a military operation during which Turkish troops seized 37% of the island, leading to a significant population movement. The resulting cultural separation still exists today. Under the auspices of the UN, programs have been put in place to find a solution which is acceptable to both sides.

The Republic of Cyprus became a member of the EU on May 1, 2004 and joined the Eurozone on January 1, 2008. The EU and UN have only recognized the government of the Republic of Cyprus (EU) as a legal government.

Official Language: Greek / English

The relocation of the personal and tax residence to Cyprus is neither expensive nor overly bureaucratic. EU citizens have three different options when planning their relocation, which are outlined below.

On top of this, Cyprus offers , all immigrants the opportunity to assume the so-called Non Dom status. This is especially interesting from an economic standpoint.

The significant benefits which may be reaped from relocating to Cyprus and acquiring the Non Dom status are one of a kind, incomparable to anywhere else in Europe.

All owners and shareholders of companies have a right to a share of the profits of the company. These so-called dividends are usually subject to income tax.

Persons with Non Dom status in Cyprus are not subject to income tax on dividends. This applies regardless of where the Non Dom’s company conducts its business: it may be registered in Cyprus, be an offshore company or operate in other countries.

Interest and all other investment results are tax-free! On top of this, Cyprus does not collect tax on such income regardless of the source of the interest or investment results, be it from within Cyprus or from abroad.

A person with Non Dom status in Cyprus has the right to conduct business via so-called offshore companies. This means a lot of flexibility for individuals owning zero-tax-companies and offshore bank accounts, as well as a full tax exemption for all profits gained from their offshore activities.

If an individual wishes to conduct international business out of Cyprus and therefore needs business premises and a business tax file number in order to take advantage of value added tax, he should strongly consider setting up a legal person in Cyprus.

Besides the fact that Cyprus has one of the lowest corporate taxes in Europe, setting up a limited liability company (LLC) in Cyprus has another distinct advantage:

Prerequisites for Relocation to Cyprus

Close this window and return to our website. There you can find out, step-by-step, how to relocate your tax residence to Cyprus and apply for Non Dom status, safely, quickly, and with no complications.

Cyprus is not only a paradise for companies and their owners and shareholders, but also for private investors and traders. No other EU member state grants wealthy private persons and companies such a wide range of possibilities and tax benefits.

The Non Dom countries UK, Malta, Ireland & Co. offer foreign individuals who have relocated their tax residence the opportunity to be subject to exclusively UK tax regulations. This is the so-called Non Dom status, and resembles the program run in Cyprus.

However, unlike the EU member state Cyprus, the Non Dom status in these countries have a significant disadvantage. In Malta, Ireland, UK & Co. the Non Dom Status is linked to a complicated and detrimental tax regulation: the so-called Remittance Base Taxation.

What does „Remittance Base Taxation“ mean?

To be exempt from the taxation, the respective capital must be moved, held and distributed via a bank account outside the Non Dom country. It may not be moved into the Non Dom country or be used there.

On top of this the capital may not be originate from domestic sources. If the individual with Non Dom status disregards these regulations, any capital related to the breach will be subject to the regular income tax of the respective country, regardless of the Non Dom status.

The Disadvantages

There are several examples that demonstrate that this regulation can cause enormous problems in day-to-day business operations and private affairs, in effect leading to the opposite of “simplified tax structures”:

For example, an entrepreneur moves to the island of Malta to take advantage of the tax benefits of the Non Dom status there. But due to the Remittance Base Taxation he is subject to the following restrictions:

If the Non Dom individual wants to conduct his business locally but also wants to benefit from the low corporate taxes by basing his corporation in Malta, any dividends that he earns would be subject to the regular income tax applicable in Malta.

Even merely using his international credit card in Malta will lead to the fact that any overseas capital that is thereby made available in Malta will be subject to the 35% Income Tax.

Conclusion: Apart from the fact that correctly splitting the different incomes and their uses can quickly become an accounting nightmare, the Remittance Base taxation also causes significant issues in day-to-day life. How is a Non Dom living in Malta supposed to cover ongoing costs, living expenses, investments and purchases?

Definitely not tax free!

To compensate for the disadvantages arising from the Remittance Base taxation, internet based company set-up agencies offer a so-called Holding Model for Malta. To conclude, let’s take a look at this “solution”.

Short and Sweet: the Malta Holding Model

In order to stay financially flexible and not have to give up the tax benefits of the Non Dom status in Malta, the Non Dom sets up not only one company in Malta, but at least two – one operational company and one Malta Holding.

The sole shareholder-owner of the operational Malta company is the Malta Holding company. In turn, the Malta Holding Company is owned by a company or private person outside Malta.

On top of this, several points must be taken into consideration so that this construct remains legal in practice. For example, it must be avoided that either the operational Malta company or the Malta Holding company is suspected of being an illegal intermediate company. This is the case when either company is not substantively a company (for example, it is just a shell company with no employees or offices) or is run completely from abroad.

This example, which can also be found in publications regarding the UK, Ireland & Co., prompts the question: “why take the difficult path when there is an simple one?“

Objectively speaking, Cyprus is a paradise for entrepreneurs, self-employed persons, freelancer, e-commerce, offshore businesses and much more. And the 60 day regulation, means that Non Dom’s of Cyprus have enough time to spend in countries of their own choice. Flexible, tax free and safe.

Within the framework provided by the OECD CRS and EU-FATCA information from banks is only reported to the country in which the respective account holder, or beneficial owner, has his tax residence.

If the account holder of a private or business bank account has his tax residence in Cypurs, all domestic and overseas banks will only report the relevant information to Cyprus. Which information is relevant is decided by the OECD CRS and EU-FATCA.

Cyprus does not collect taxes on interest and investment results, regardless of their origin. In addition, foreigners in Cyprus are exempt from any taxes on dividends from domestic and foreign companies under the Non Dom program.

A tax residence in Cyprus in conjunction with Non Dom status grants the individual ultimate privacy and complete financial freedom.

A tax haven is normally defined by substantially lower income taxes. This means that, if the income tax of a the destination country is significantly less than that of the country of origin, the tax authorities will regard it as a tax haven. The income tax in Cyprus usually amounts to 35%.

Tax exemption regulations, like the “50% income tax reduction“ which foreigner can take advantage of via the Non Dom status, are legally seen only as exemptions and do not make Cyprus a tax haven.

The corporate tax in Cyprus of 2.5%, or 12.5%, is part of the final tax assessment. In this regard, Cyprus foregoes progressive taxation, or taxation by instalments, and thus „saves“ business owners and shareholders complicated tax returns, applications for tax reimbursements and associated waiting periods.

As a full-fledged company with a corporate tax file number and offices, it is possible to conduct business operations internationally (Limited Liability Company may be compared to the German GmbH or the spanisch Sociedad de responsabilidad limitada, referred to as SL).

Cyprus does not collect trade taxes, nor are there statutory defense or welfare contributions

If the Cyprus Company owns shares in another company, all dividend earnings are exempt from taxes!

Earnings from stock trading and most other form of investment are also tax-free.

If the Cyprus Company makes losses, these can be carried over *

The offices of the Cyprus can usually be registered at the private residence of the sole shareholder-owner (this does not include manufacturing plants). This regulation is especially advantageous for individuals with the Non Dom status in Cyprus, as this means that the costs of rent fall under business expenses.

If so desired, Cyprus based bank accounts can also be maintained from abroad (capital protection clause).

In Cyprus the inheritance of shares in companies is exempt from taxes.

Cyprus offers business owners and shareholders these and many other benefits. In conjunction with ensuring Non Dom status for one or more of the business owners or shareholders, setting up a company in Cyprus is a great variation to relocating your tax residence to Cyprus. The Cyprus Company offers valuable, long-term benefits and those with Non Dom status have access to their dividends tax free.

| OPTION C: FINANCIALLY INDEPENDENT PERSONS (Note 2)* 1 Person |

|

| Original Passport (Proof of Identification). Valid for at least 6 months | |

| Certificate of Employment (signed and stamped by the employer no more than one week before the appointment). | not applicable |

| Proof of payment of insurance contributions for the last 2 months, in case certificate of employment cannot be provided. | not required |

| Application fee of € 20.00 (exact amount in cash) | required |

| Proof of valid health insurance (in- and out-patient treatments). Options:

If the health insurance provider is based in another country, the respective agreement must be provided. Proof must be provided that the current health insurance covers both in- and out-patient treatment costs. |

required |

| Rental agreement or title deeds (in the case of ownership) | required |

| Bank account statements covering the last 6 months must be provided as proof of income. The statements provided must be certified by the respective bank. | required |

| Minimum stay per year | 183+ Days |

| Note 1: | A Cyprus mobile phone required - No contractual commitment needed (Pay As You Go) |

| Note 2: | * If the applicant is the owner of, for example, a foreign or an offshore company, he/she must also provide documentation of the related monthly income by providing bank account statements from the private account of the applicant (minimum monthly income of approx. € 2,500.00 - proof for the last 3 to 6 months). |

Business accounts (and/or the holders) are seen to be non-reportable, if the company in question does not generate an active income from regular business operations, as defined by the OECD.

The term „regular business operations“ particularly points towards commercial business with a fixed base of operations (offices).

The OECD criteria to assess whether a company generates active income and therefore qualifies as an Active Company – and thus is not subject to the automatic information exchange - are as follows:

Important: only one of these criteria needs to be met, in order for a company to qualify as an "Active Company"!

Company structure: FZE (1 owner)

Visa: 1

Field: Market Research

Market Research:

| Set-Up Fees | |

| Permit from the immigration office | USD 70.00 |

| Individual/Professional Licence incl. Flexi Desk | USD 4,575.00 |

| Administration and Management/AML Compliance Assessment | USD 1,360.00 |

| Total | USD 6,005.00 |

| Annual Fees (per 12 months after Set-Up): | |

| Licence renewal | USD 4,575.00 |

| Administration and Management/AML Compliance Assessment | USD 1,360.00 |

| Total | USD 5,935.00 |

UAE Tax Domicile Certificate

| EUR | USD | |

|---|---|---|

| Activation Fees | 25.00 | 35.00 |

| Monthly Fees | 10.00 | 15.00 |

| Top-Up | 5.00 | 8.00 |

| ATM Fees | 2.00 Euro + 1,5% | 2.50 USD + 1,5% |

| POS | 1.50 | 2.00 |

| ATM Refusal | 1.00 | 1.00 |

| POS Refusal | 1.00 | 1.00 |

| Lost/Blocked/Refunded | 50.00 | 50.00 |

| Cancellation | 20.00 | 20.00 |

| Chargeback Fees | 20.00 | 20.00 |

| Inactive (90 Days) | 15.00 | 15.00 |

| Courier | Real costs | Real costs |

The following notes give a simple overview of what happens to your personal information when you visit our website. Personal data is all data that can be used to personally identify you. Detailed information regarding data protection can be found in our Privacy Policy, which follows below.

Who is responsible for the data collection on this website?

The data processing on this website is carried out by the website operator, whose contact details may be found in the Legal Notice of this website.

How do we collect your data?

On the one hand, your data will be collected if you share personal information with us. For example, this may be the data which you enter into a contact form.

Other data is collected automatically by our IT systems when you visit this website. These are mostly technical data (for example, the internet browser, operating system and time of the page request). The collection of this data happens automatically as soon as you enter our website.

What do we use your data for?

Part of the data is collected to ensure that the website is kept in good working order. Other data can be used to analyse your user behaviour.

What rights do you have regarding your data?

You have the right to obtain free information about the origin, recipient and purpose of your stored personal data at any time. You also have the right to request the correction, blocking or deletion of this data. For this purpose, and in case you have further questions about data protection, you can contact us at the address given in the Legal Notice at any time. Furthermore, you have a right to appeal to the competent regulatory body.

The operators of these pages take the protection of your personal data very seriously. We treat your personal data confidentially and in accordance with the relevant data protection laws and this Privacy Policy.

If you use this website, various personal data will be collected. Personal information is information that makes it possible to personally identify you. This Privacy Policy explains which information we collect and we use it for. It also explains how and for what this data is collected.

Please note that there potential security gaps in data transmission over the internet (for example, communication via e-mail). Complete protection of the data from access by third parties is therefore not possible.

The responsible Authority for the processing of data related to this website is:

Privacy Management GroupLtd.

Lawyers | Chartered Accountants | Management Consultants

European Service Centre

61-63 Lord-Byron-Street, 5th Floor

6023 Larnaca, Cyprus

Phone: +357 240 204 00

Email: backoffice@tax-residence.com

The responsible authority is the natural or legal person who, alone or in concert with others, decides on the purposes and means of processing personal data (such as, names, email addresses, etc.).

Many data processing operations are only possible with your express consent. You can revoke your consent at any time. To do this, an informal message sent to us via email is sufficient. The legality of the data processing carried out until the time of consent withdrawal remains unaffected by the withdrawal.

For security reasons and to protect the transmission of confidential information, such as orders or requests which you send to us as the site operator, this site uses SSL or TLS encryption. You can detect an encrypted connection by examining the address line of the browser: when encrypted the “http://” changes to “https://” and the lock symbol appears in the browser line.

If SSL or TLS encryption is enabled, the data you submit to us cannot be seen by third parties.

If, after the conclusion of a fee-based contract, there is an obligation to provide us with your payment details (for example, the account number for direct debit authorisation), this data will be required for payment processing.

Payment transactions via the common means of payment (Visa / MasterCard, direct debit) are made exclusively via an encrypted SSL or TLS connection. You can detect an encrypted connection by examining the address line of the browser: when encrypted the “http://” changes to “https://” and the lock symbol appears in the browser line.

When SSL or TLS encryption is enabled, the payment details that you submit to us cannot be seen by third parties.

We have appointed a data protection officer for our company.

Yiannis Papapetrou

61-63 Lord-Byron-Street, 5th Floor

6023 Larnaca, Cyprus

Telefon: +357 240 204 45

E-Mail: yp@eu-ibc.com

The internet pages partly use so-called cookies. Cookies do not harm your computer and do not contain viruses. Cookies serve to make our offer more user-friendly, effective and secure. Cookies are small text files, which are stored on your computer and saved by your browser.

Most of the cookies we use are so-called “session cookies”. They are automatically deleted after your visit. Other cookies remain stored on your device until you delete them. These cookies allow us to recognise your browser the next time you visit.

You can set your browser so that you are informed about the setting of cookies and allow cookies only in individual cases, block cookies only in certain situations or in general, and activate the automatic deletion of cookies when closing the browser. Disabling cookies may limit the functionality of this website.

Cookies which are necessary to carry out the electronic communication process or to provide certain functions that you wish to use (for example, the shopping cart function) are placed on the basis of art. 6 para. 1 lit. f GDPR. The website operator has a legitimate interest in the placing of cookies which serve to ensure the optimal provision of services, free of all technical errors. With regard to other cookies (for example, cookies for analysing your surfing behavior), these will be treated separately in this Privacy Policy.

The provider of the pages automatically collects and stores information in so-called server log files, which your browser automatically transmits to us. These are:

The data will not be merged with data from other sources.

The basis for data processing is art. 6 para. 1 lit. b GDPR, which allows the processing of data in order to fulfill a contractual obligations or pre-contractual measures.

When you send us inquiries via the contact form, the information you provided in the form, including the contact details you indicated there, will be stored in order to process the request and in case of follow-up questions. We will not share this information without your consent.

The processing of the data entered into the contact form therefore follows exclusively based on your consent (art. 6 (1) lit. GDPR). You can revoke this consent at any time. An informal message sent to us via email is sufficient. The legality of the data processing operations carried out until the time of the withdrawal of consent remains unaffected by the withdrawal.

The information you provide in the contact form will remain with us until you ask us to delete it, revoke your consent for us to store it, or until the time that the purpose for data storage expires (for example, when your request has been processed). Mandatory legal provisions – specifically storage periods – remain unaffected.

If you would like to receive the newsletter offered on the website, we need an email address from you, as well as information that allows us to verify that you are the owner of the specified email address and that you agree to receive the newsletter. Further data shall only be collected on a voluntary basis, if at all. We use this data exclusively for the transmission of the requested information and do not pass it on to third parties.

The processing of the data entered into the newsletter registration form takes place exclusively on the basis of your consent (art. 6 (1) lit. GDPR). The consent to the storage of the data and the email address, as well as their use for sending the newsletter can be revoked at any time, via the “unsubscribe” link in the newsletter. The legality of the already completed data processing operations remains unaffected by the withdrawal of consent.

The data deposited with us for the purpose of receiving the newsletter will be stored with us until such a time that you unsubscribe from the newsletter and will be deleted once you unsubscribe from the newsletter. Data which has been saved by us for other purposes (for example, email addresses for the members-only area) remains unaffected.

This website uses the services of MailChimp in order to send newsletters. The provider is the Rocket Science Group LLC, 675 Ponce De Leon Ave. NE, Suite 5000, Atlanta, GA 30308, USA.

MailChimp is a service with which the dispatch of newsletters can be organised and analysed. When you enter data for the purpose of newsletter subscription (for example, an email address) this will be stored on MailChimp’s servers in the United States.

MailChimp is certified under the “EU-US Privacy Shield”. The “Privacy Shield” is an agreement between the European Union (EU) and the US to ensure compliance with European privacy standards in the United States.

With the help of MailChimp we can analyse our newsletter campaigns. When you open an email sent by MailChimp, a file included in the email (a so-called web beacon) connects to MailChimp’s servers in the United States. Through this it can be determined if a newsletter message has been opened and which links have been clicked on. In addition, technical information is collected (for example, time of retrieval, IP address, browser type and operating system). This information cannot be assigned to the respective newsletter recipient. It is used exclusively for the statistical analysis of newsletter campaigns. The results of these analyses can be used to better tailor future newsletter to the interests of the recipients.

If you do not want to subject your data to analysis by MailChimp, you must unsubscribe from the newsletter. To do this, we provide a corresponding link in each newsletter message. Furthermore, you can directly unsubscribe from the newsletter on the website.

Data processing is based on your consent (article 6 (1) (a) GDPR). You can revoke this consent at any time by unsubscribing from the newsletter. The legality of the already completed data processing operations remains unaffected by the withdrawal of consent.

The data deposited with us for the purpose of receiving the newsletter will be stored with us until such a time that you unsubscribe from the newsletter and will be deleted from both our servers and MailChimp’s servers once you unsubscribe from the newsletter. Data which has been saved by us for other purposes (for example, email addresses for the members-only area) remains unaffected.

For more details, see MailChimp’s Privacy Policy at: https://mailchimp.com/legal/terms/.

Our website uses plugins from the Google-powered site “YouTube”. The site operator is YouTube, LLC, 901 Cherry Ave., San Bruno, CA 94066, USA.

When you visit one of our YouTube plugin-enabled sites, you will be connected to YouTube’s servers. As a result, the YouTube servers are informed about which of our pages you’ve visited.

If you are logged into your YouTube account, this will allow YouTube to link your browsing behavior directly with your personal profile. You can prevent this by logging out of your YouTube account.

The use of YouTube is in the interest of an attractive presentation of our online offers. This constitutes a legitimate interest within the meaning of art. 6 para. 1 lit. f GDPR.

For more information about the processing of user data, please refer to the YouTube Privacy Policy at: https://www.google.en/intl/en/policies/privacy.

This site uses the mapping service Google Maps via an API. The provider is Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, USA.

To use the features of Google Maps, it is necessary to save your IP address. This information is usually transmitted to and stored by Google on servers in the United States. The provider of this site has no influence on the transmission of this data.

The use of Google Maps is in the interest of an attractive presentation of our online offers and to make it easy to locate the places we have indicated on the website. This constitutes a legitimate interest within the meaning of art. 6 para. 1 lit. f GDPR.

For more information on the processing of user data, please refer to Google’s Privacy Policy: https://www.google.en/intl/en/policies/privacy.

Note & Consent: Once you have subscribed to a newsletter or other emails about current projects of Privacy Management Group, we will keep records of how you use our websites, in order to provide you with a service tailored to your specific interests. The personal data we record includes timestamps and information regarding which particular pages you visit. By clicking on buttons such as "Download" or "Subscribe now", you also consent to this registration of data. Further information can be found in our privacy policy.

I can revoke my consent pertaining to data registration by Privacy Management Group at any time. An email relaying this request is sufficient.

Our live chat is currently unmanned or congested.

Please try again later. Mon - Fri from 8:00 a.m. - 3:00 p.m. (EET)