07.1a About Us

Privacy Management Group, short PMG, is an international consultancy firm and Corporate Service Provider, specialised in the establishment, management and administration of international companies. Generally these activities include corporate re-structuring to support the international tax planning needs of our clients, wealth protection, cross-border investment and foreign market entry.

As a leading global Corporate Service Provider (CSP), we offer clients a vast experience, providing a wealth of expertise with our worldwide network of highly qualified staff.

We strive to understand our customers, treat them with respect, and go the extra mile to help them. Our name stands for security, service and recognition. This reputation attracts customers and business partners, inspires our staff, and is valued by customers.

Countries - Cyprus

The Cyprus office employs Management Consultants, Accountants, Legal Advisors, Incorporation Specialists and an IT Security Specialist and maintains associations with different service providers operating in a similar field on a worldwide basis.

Our Bank Account Opening and Administration Department ensures that clients benefit from efficient and reliable financial services and support.

Our Compliance Department and dedicated Anti-Money Laundering Compliance Officer, undergoes constant training, and thus safeguards compliance with the latest international standards. We employ an international freelance team of legal experts, translators, internet programmers, website developers and SEO specialists who monitor and update our websites and internet operations on a daily basis.

Our compliance standards are amongst the best in the industry, we are ISO certified and, where required, we are Licenced Corporate/Administration Service Providers and Accountants.

Cyprus Operations

PMG is regulated by the “Institute of Certified Public Accountants of Cyprus (ICPAC)”. We incorporate companies on behalf of its founding members and also act as the Resident/Registered Agent for companies under our management. All bookkeeping, VAT – Value Added Tax, VIES -Vat International Exchange System and auditing work is completed under one roof.

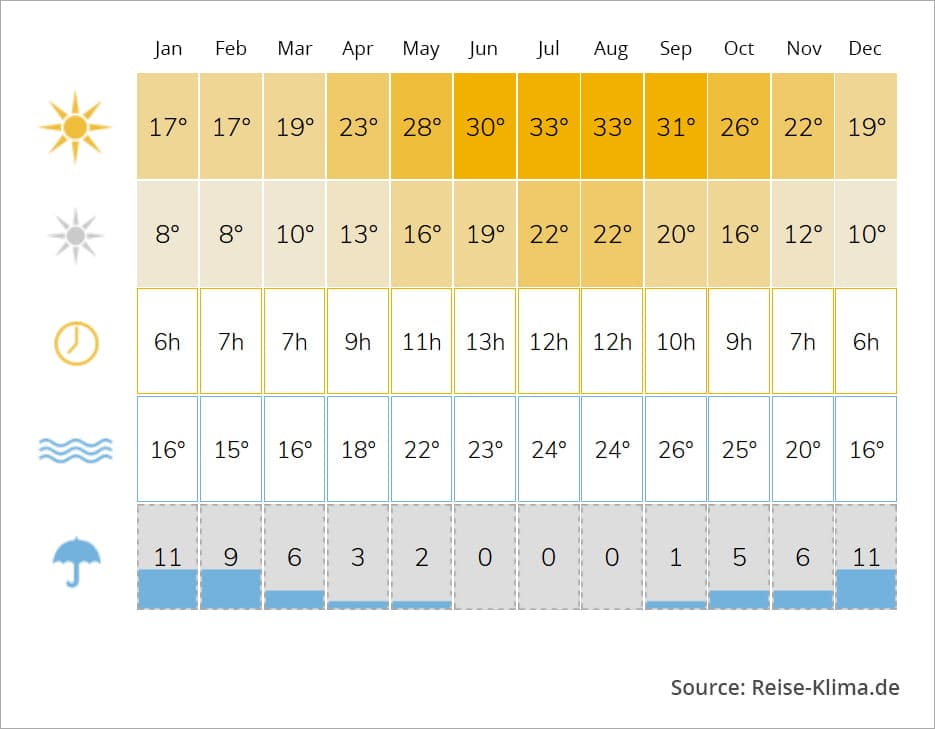

We Have Chosen Cyprus As A Base

Cyprus has one of the most attractive tax regimes in Europe and its association with the OECD guarantees its loyalty to the internationally agreed tax standards. Other advantages include the fact that the Cyprus corporate tax is at the advantageous flat rate of 12,5%, which is among the lowest in the EU. Furthermore, international corporate structures involving Cyprus in conjunction with other countries, regardless whether high or low tax jurisdictions, are fully acknowledged.

Strategic Location in Europe

The island is the third largest in the Mediterranean Sea and has positioned itself as a true financial hub and professional services centre for thousands of international companies. Cyprus is also an ideal gateway and platform for conducting business and investments in Europe (EU and non-EU, such as Eastern Europe, Russia and CIS), as well as neighbouring markets in North Africa and the Middle East, notably the United Arab Emirates.

Our Office in Cyprus

The European client centre is located in Larnaca, Cyprus, approximately 15 minutes by car from Larnaca International Airport and ideal to run effective meetings, getting down to business and flying back to Europe the same day, or after an enjoyable dinner with a sea view, taking the first flight back in the morning.

How We Do Business

Based in Cyprus our clientele is mainly European. Many clients prefer to travel short distances and conduct meetings in their native language. Our staff is multilingual and we act as “the intermediary between client and government authorities” in Cyprus, the United Arab Emirates and other offshore jurisdictions.

How Clients Find Us

Generally we have 3 types of clients:

- The Direct Client

The direct client has responded to our international marketing programmes such as paid internet commercials, organic ranking websites and more. - The Referral

These are clients referred to us by existing clients. - Agents

The professional partner, lawyer, accountant, consultant and banker, who is a member of our Agent Network Portal of Management Consultants | Chartered Accountants | Lawyers, who set up companies on behalf of their clients.

Countries - The United Arab Emirates

PMG established a base - Consultancy, Registered Agents and Administration - in Ras Al Khaimah, United Arab Emirates, in February 2012 with the main objective of bringing international investors, mainly from Europe to the UAE, notably RAK Offshore and RAK Free Zone. We opened a second office in 2016 to attract investors, reflecting on the launch of EXPO 2020, in the DWC Free Zone (Dubai South).

We combine European core values and efficiency with Arabian economic strength and the governmental approach of the UAE to encourage the growth of the private sector.

Our clients understand that this alliance combined with a number of other factors, provide their businesses with an anchor of stability.

The UAE operation works hand in hand with the Cyprus Client Centre, which is the European Springboard to the United Arab Emirates.

Worldwide Network of Management Consultants, Chartered Accountants and Lawyers

PMG operates an agent network platform that enables international professionals to provide corporate solutions to their clientele. Staff members such as lawyers and consultants are able to check the current incorporation status, commission statistics, own marketing campaigns and reference links.

Services

- Incorporation of International Companies

- Bookkeeping, VAT, VIES and Auditing Preparation

- Payroll Services and Social Insurance Compliance

- Tax Compliance

- Legal and Tax Advice in Cyprus

- Registration of Intellectual Property

- Virtual Offices Services

- Registered Office/Agent Services

- Introducers to International Banks and Premium Card Issuers

- Bank Account Opening Services and Support

- Friendly Multi-Lingual Staff

- Relocation Services – Home/School/Office/Health Insurance Finder

- Visa and Immigration Services in Cyprus and the UAE

- Passport by Investment Promoter

- European Permanent Residence Services

AML Anti-Money Laundering and KYC Compliance

We have implemented an established anti-money laundering programme designed to achieve and meet the requirements for operations in Cyprus, the United Arab Emirates and other jurisdictions. The programme calculates the risk for clients.

Quality Policy

The company ensures the quality of the provided services by applying an integrated system of quality control certified by ISO 9001 and implementing the undertaken projects with modern administration methods.

Privacy Management Europe is fully ISO Certified and a member of the Institute of Certified Public Accountants of Cyprus (ICPAC – SELK). It is licenced by ICPAC to provide Accounting and Administration Services and to administrate companies registered in Cyprus.

Lawyers & Chartered Accountants

![]() Privacy Management GroupLtd.

Privacy Management GroupLtd.

Lawyers | Chartered Accountants | Management Consultants

European Service Centre

61-63 Lord-Byron-Street, 5th Floor

6023 Larnaca, Cyprus

Mon – Fri 9:00 – 16:00 (GMT+2)

Phone: +357 240 204 00

E-Mail: backoffice@tax-residence.com

Important: only one of these criteria needs to be met, in order for a company to qualify as an "Active Company"!

Important: only one of these criteria needs to be met, in order for a company to qualify as an "Active Company"!