Republic of Cyprus (EU)

Dubai and the UAE

Digital Nomads

Advice and Support

Privacy Management Group

02.6 Services and Fees

-

Company formation

with Non-Dom -

Simply Non-Dom

business registration -

HNWI - Financially

independent persons

CYPRUS COMPANY FORMATION INCL. RESIDENTIAL RELOCATION & NON-DOM STATUS

Free Consultation

Free Consultation during the Preparation Phase

Privacy Management Group in Cyprus has been employing specialists from Switzerland, Germany, France and other European countries for over ten years. Our in-house employees therefore know from their own extensive experience in which areas you will need active support. Based on the experience built over more than 30 years as lawyers, tax advisers and consultants as well as other specialised experience of our colleagues, the following service programme was developed for you.

Already during the planning phase can you rely on our experience and specialised knowledge and benefit from the following services:

- Free introductory consultation in our office, by telephone or Skype

- Free use of our Live Chat for any questions that arise in the planning phase

- Free initial consultation with our lawyers, tax advisers and in-house specialists

Moreover, we are of course at your disposal for any questions in relation to education, real estate, life in Cyprus, the social system, etc…

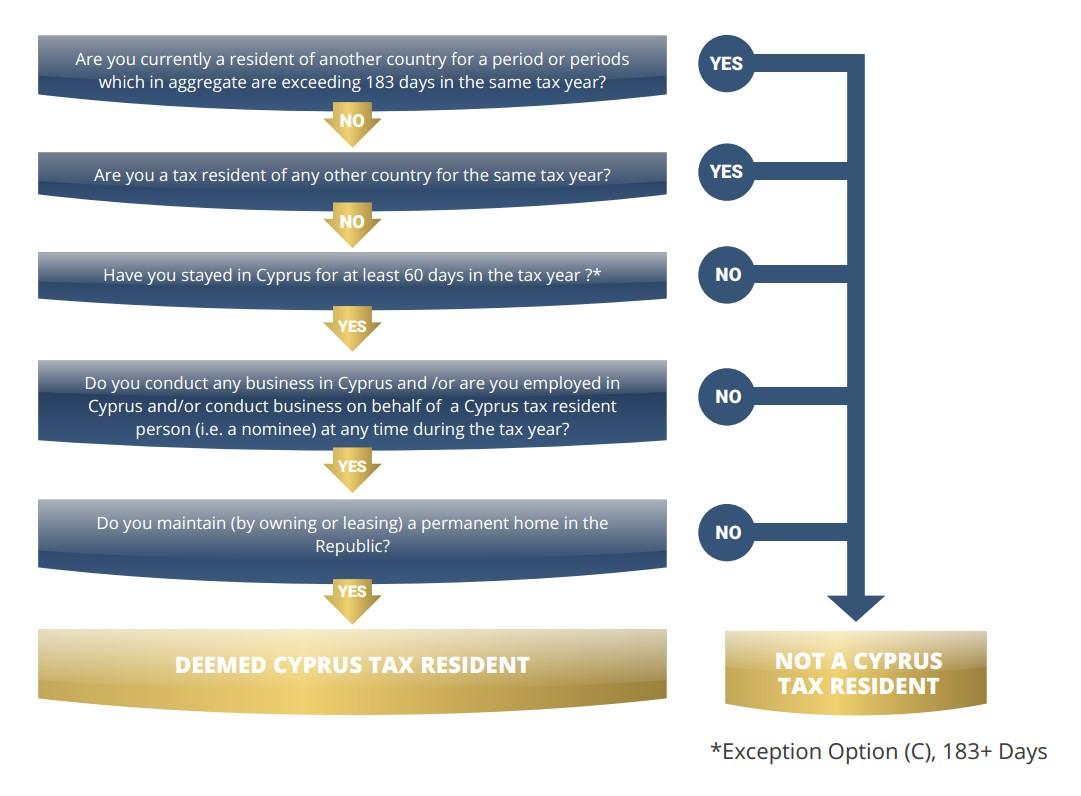

Requirements for Non-Dom Status in Cyprus

Company Set-Up incl. Residency and Non-Dom Status

Company Formation in Cyprus

Our law firm has been a member of the Cyprus Bar Association for over 30 years and our tax advisers are permanent in-house employees of Privacy Management Group. Privacy Management Group can therefore provide a complete and independent service without the need for agents. The formation costs of your company, Cyprus Limited or Cyprus Holding, amounts to a one-off and all-inclusive fee of € 2,850.00, exclusive of VAT.

The Full-Service-Package includes:

- Legal and tax advice

- Company name check for availability

- Preparation of the memorandum and articles of association

- Certification of the registration documents, incl. translation (English)

- Welcome kit and service manual

- Local representation

Bank accounts

- Assistance on opening a business bank account in Cyprus

- Assistance on opening a personal bank account in Cyprus

Trusteeship

- Upon request, management of fiduciary services

Legal and tax advice

- Application for a tax number for individuals and companies

- Application for a VAT number

- Preparation of your company's opening balance sheet

- Ongoing bookkeeping and income tax accounting

- Drawing up employment contracts

- Preparation of payroll

- Application for the necessary social insurance number(s)

- Cyprus legal and tax advice

Operational services for your company in Cyprus

- Facilitation to find suitable premises to represent your business

- Review of rental offers and contracts through our in-house lawyers

- Authentication of the rental contract after completion

- Support with the application for your telephone and internet connections

- Typically a simple office with 1 room costs approximately € 200.00

Please allow approximately ten working days for this complete process, including registration.

One location for all services. Experienced accountants, tax experts, and legal professionals make up our team. They are always ready to help. The necessary Cyprus ICPAC certification is held by our firm.

Appointments with the authorities regarding Non-Dom status

Residency and Non-Dom Status

Approved by ICPAC Cyprus, we can now actively accompany you through the process of settlement in Cyprus and can therefore ensure your enjoyment of the enormous advantages of the Non-Dom programme. For the service provided within the ‘Residence and Non-Dom Status’ programme we charge a one-time fee of € 490.00 per person exclusive of VAT.

Our services:

- Preparation of the required documents and contracts for the authorities

- Activation of your social security number (required upon registration!)

- Support during the property search (rental or purchase)

- Arrangement of appointments with local authorities

- Personal accompaniment during the process of registering yourself and your family with the relevant authorities

- Support during the application process for your personal tax number, including application for non-domestic status

Please account approximately five working days for this complete procedure, including registration.

Annual fees due every 12 months after company formation

Tax advice, ongoing bookkeeping, accounting and Non-Dom

All services provided by a single source! We exclusively employ lawyers, tax advisers and accountants with years of experience and they are happy to help you or your company at any time. Our company of course has the in Cyprus required ICPAC certification.

Our annual fees, due every 12 months include the following services:

- Ongoing support by email, telephone, or in person at our offices

- Tax advice for your business

- Full accounting and audit services

- Financial record preparation

- VAT declaration per quarter

- Audit services: examine financial records by independent auditors to ensure they are accurate and comply with tax laws and regulations

- Risk evaluation: Accountants and auditors identify potential areas of risk and opportunity

- Tax preparation - We ensure taxes are paid properly

- Consulting services

- Tax season debriefing

- Payroll processing Services

- Appeals to resolve disputes (if necessary)

Administration and other services

- Trusteeship fees (if requested), General Power of Attorney,

- Local support and advice.

Personal tax returns and Non-Dom in Cyprus

- Personal tax advice (Non-Dom in Cyprus),

- Support by e-mail, telephone or in person at our office,

- Preparation of tax returns at the end of the calendar year,

- Communication with the financial authorities in Cyprus,

- Auditing of the tax assessment,

- Local representation.

Calculation of annual fees including bookkeeping, accounting and attestation

Please select the number of transactions to be expected within the first twelve months:

Annual fees for the services outlined above

The annual fees are based on the actual number of transactions within a calendar year. For this reason, the annual fees may decrease or increase during the course of the calendar year. Calculation basis / number of expected transactions in the next 12 months: No transactions (inactive company).

| Summary of all fees | ||

| Formation fees | one-off | € 2,850.00 |

| Residence and Non-Dom status | one-off | € 490.00 |

| Tax consulting, ongoing accounting services (Annual administration fees for no transactions) |

annually | 1,750.00 € |

| UBO Registration Service (optional) | one-off | € 250.00 |

| TOTAL | 4,890.00 €* | |

*plus 19% VAT

SIMPLY NON-DOM (BUSINESS REGISTRATION) - NATIONAL SOLE PROPRIETORSHIP

Free Consultation

Free Consultation during the Preparation Phase

Privacy Management Group in Cyprus has been employing specialists from Switzerland, Germany, France and other European countries for over ten years. Our in-house employees therefore know from their own extensive experience in which areas you will need active support. Based on the experience built over more than 30 years as lawyers, tax advisers and consultants as well as other specialised experience of our colleagues, the following service programme was developed for you.

Already during the planning phase can you rely on our experience and specialised knowledge and benefit from the following services:

- Free introductory consultation in our office, by telephone or Skype

- Free use of our Live Chat for any questions that arise in the planning phase

- Free initial consultation with our lawyers, tax advisers and in-house specialists

Moreover, we are of course at your disposal for any questions in relation to education, real estate, life in Cyprus, the social system, etc…

SIMPLY NON-DOM Complete Package

Complete Package

Our law firm has been a member of the Cyprus Bar Association for over 30 years and our tax advisers are permanent in-house employees of Privacy Management Group. Privacy Management Group can therefore provide a complete and independent service without the need for agents.

The SIMPLY NON-DOM Complete Package includes:

- Free advice and support regarding legal and tax issues;

- Business registration;

- Application for a Tax File Number;

- Application for the mandatory Social Security Number;

- Support with immigration and residency, such as application for the permanent residence and work permit;

- Checking off the criteria for Non-Dom Status;

- Assistance with the opening of a bank account at the institution of your choice (International Department);

- Free support in your search for a place to live in Cyprus (whether you wish to rent or buy).

Annual-Service

Tax advice, ongoing bookkeeping, accounting and Non-Dom

The annual fees, due every 12 months, include the following services:

Annual-Service (per 12 months)

- Tax advice (both private and for your company);

- Ongoing bookkeeping services;

- Regular reporting to the social insurance provider (as required by law);

- Preparation of annual tax returns (up to € 70,000.00 per year);

- Preparation of the annual balance sheet (from € 70,000.00 per year);

Calculation of annual fees including bookkeeping, accounting and attestation

Please select the number of transactions to be expected within the first twelve months:

- Support by email, telephone or in person at our offices;

- Communication with the financial authorities in Cyprus;

- Auditing of the tax assessment;

- Local representation.

The fees for the Annual-Service depend on the actual number of transactions in the calendar year. Because of this, the fees for the Annual Service may increase or decrease over the course of the year.

Extra Services SIMPLY NON-DOM

Extra Services

Approved by ICPAC Cyprus, we can now actively accompany you through the process of settlement in Cyprus and can therefore ensure your enjoyment of the enormous advantages of the Non-Dom programme.

Extra Services SIMPLY NON-DOM:

- Fast-Track-Service incl. personal accompaniment:

- Water Board

- Electricity Authority

- Telephone Service Provider

| Summary of all fees | ||

| Complete Package | one-off | € 1,249.00 |

| Tax consulting, ongoing accounting services (Annual administration fees for Gesellschaft ohne Aktivitäten) |

annually | € 950.00 |

| Extra Services | one-off | € 119.00 |

| TOTAL | € 2,616.81* | |

*plus 19% VAT

Financially independent persons

Free Consultation

Free Consultation during the Preparation Phase

Privacy Management Group in Cyprus has been employing specialists from Switzerland, Germany, France and other European countries for over ten years. Our in-house employees therefore know from their own extensive experience in which areas you will need active support. Based on the experience built over more than 30 years as lawyers, tax advisers and consultants as well as other specialised experience of our colleagues, the following service programme was developed for you.

Already during the planning phase can you rely on our experience and specialised knowledge and benefit from the following services:

- Free introductory consultation in our office, by telephone or Skype

- Free use of our Live Chat for any questions that arise in the planning phase

- Free initial consultation with our lawyers, tax advisers and in-house specialists

Moreover, we are of course at your disposal for any questions in relation to education, real estate, life in Cyprus, the social system, etc…

Financially independent persons - Complete Package

Complete Package

Our law firm has been a member of the Cyprus Bar Association for over 30 years and our tax advisers are permanent in-house employees of Privacy Management Group. Privacy Management Group can therefore provide a complete and independent service without the need for agents.

Financially independent persons - Complete package includes:

- Free advice and support regarding legal and tax issues;

- Verification of all requirements;

- Application for a Tax File Number;

- Application for / Approval of the Health Insurance status;

- Support with immigration and residency, such as application for the permanent residence and work permit;

- Checking off the criteria for Non-Dom Status;

- Assistance with the opening of a bank account at the institution of your choice (International Department);

- Free support in your search for a place to live in Cyprus (whether you wish to rent or buy).

Annual-Service

Tax advice, ongoing bookkeeping, accounting and Non-Dom

The annual fees, due every 12 months, include the following services:

Annual-Service (per 12 months)

- Personal tax advice;

- Ongoing bookkeeping services;

- Preparation of annual tax returns (up to € 70,000.00 per year);

- Preparation of the annual balance sheet (from € 70,000.00 per year);

Calculation of annual fees including bookkeeping, accounting and attestation

Please select the number of transactions to be expected within the first twelve months:

- Support by email, telephone or in person at our office;

- Communication with the financial authorities in Cyprus;

- Auditing of the tax assessment;

- Local representation.

The fees for the Annual Service depend on the actual number of transactions in the respective calendar year. For this reason, the fees for the Annual Service may change over the course of the year.

Extra Services - Financially independent persons

Extra Services

Approved by ICPAC Cyprus, we can now actively accompany you through the process of settlement in Cyprus and can therefore ensure your enjoyment of the enormous advantages of the Non-Dom programme.

Extra Services - Financially independent persons

- Fast-Track-Service incl. personal accompaniment:

- Water Board

- Electricity Authority

- Telephone Service Provider

| Summary of all fees | ||

| Complete Package | one-off | € 1,490.00 |

| Tax consulting, ongoing accounting services (Annual administration fees for inactive company) |

annually | € 600.00 |

| Extra Services | one-off | € 119.00 |

| TOTAL | € 2,487.10* | |

*plus 19% VAT

Important: only one of these criteria needs to be met, in order for a company to qualify as an "Active Company"!

Important: only one of these criteria needs to be met, in order for a company to qualify as an "Active Company"!