04.2 Is Estonia an Option?

eRESIDENCY AND COMPANY SET-UP IN ESTONIA

Is Estonia really a Paradise for Digital Nomads?

Since 2014, Estonia has been offering a so-called e-Residence programme; which can complemented with the digital set-up of a company in Estonia and a Finnish and Estonian bank account. On this page, we take a detailed look at the advantages of the e-Residence programme and digital company set-up and how the two work in reality.

Since 2014, Estonia has been offering a so-called e-Residence programme; which can complemented with the digital set-up of a company in Estonia and a Finnish and Estonian bank account. On this page, we take a detailed look at the advantages of the e-Residence programme and digital company set-up and how the two work in reality.

Is this not a dream come true for Digital Nomads? A virtual (e-)residence in Estonia, digital signature via your ID-card, company set-up in less than 20 minutes, and all your bookkeeping and tax returns done in one place: online?

The truth is that the marketing professionals of Estonia have done an amazing job in selling their country. I confess that I myself gobbled up all of these beautiful sounding catchphrases when I first heard them two years ago. My thoughts went straight to all our Digital Nomad clients – wasn’t this their Golden Goose?

Today I am absolutely thankful that I listened to my colleagues, the lawyers and tax advisors in our employ, instead of taking that Golden Goose to market.

The Myth of the Golden Goose

Please bear with me during this personal interlude. I am lucky enough to have an employer who doesn’t lock me away in an office. I don’t think I could ever feel completely comfortable between all those legal texts and tax regulations. Instead, I have the opportunity to travel the world, almost without obstacles and completely at whim. And so, after almost 9 years, I too define myself as a Digital Nomad.

On top of this, I have been working for Privacy Management Group for more than a decade now. Over this time, I have acquired a reasonable wealth of experience regarding residence relocation, company set-up and tax law.

Perhaps it is possible to learn the theory of it all from the substantial stock of literature on the topic. But in reality, it is only experience that shows you how these things really work.

With this in mind, let us now examine, whether Estonia truly does offer something so new, innovative and exceptional with its e-Residence Programme and digital company set-up. What are the pros and are there any cons hiding in the shadows?

e-Residence in Estonia

The first thing to know is, that the e-Residence offered in Estonia is neither a substitute for a tax residence, nor does it grant a right to physically reside in Estonia.

This means that the e-Residence in Estonia, as well as the e-Residence card, simply allows the ‘e-Resident’ to take ‘advantage’ of digital services publicly available in Estonia, such as cost- and time-effective company formation and online accounting services.

Nonetheless, the e-Residency-Card and e-Residence do not mean that you are permitted to live in Estonia, are exclusively subject to taxation in Estonia or even have a tax residence in Estonia.

Take Away: As a Digital Nomad you are looking for a country with the least possible amount of bureaucracy, lots of flexibility regarding residency, low tax rates and without the disreputable label of being a tax haven. The e-Residence in Estonia does not offer any of these things. Not a single one.

Company Formation in Estonia, Corporate Tax and Dividends

Since 2010, the procedure for the taxation of companies in Estonia has been fully automated. Transactions exceeding 1,000.00 Euros must be reported. At the same time, unlike other EU countries, Estonia does not have a corporate tax, which means that corporate income is only taxed when it is paid out in dividends. Overall, there is a flat tax rate of 20% for residents of Estonia, a flat tax rate of 20% on dividend payout and possibly VAT.

On top of this, and this must not be forgotten, there may be taxes payable in the home country. Don’t forget, the e-Residence does not constitute a tax residence, which means that you will be remain subject to taxation in your home country. This, on top of the 20% taxes which you pay on your profit share in Estonia.

Note:

To find out why you must have a proper tax residence and why a postal address is not enough, check out our page: “Do Digital Nomads need a Residence?“.

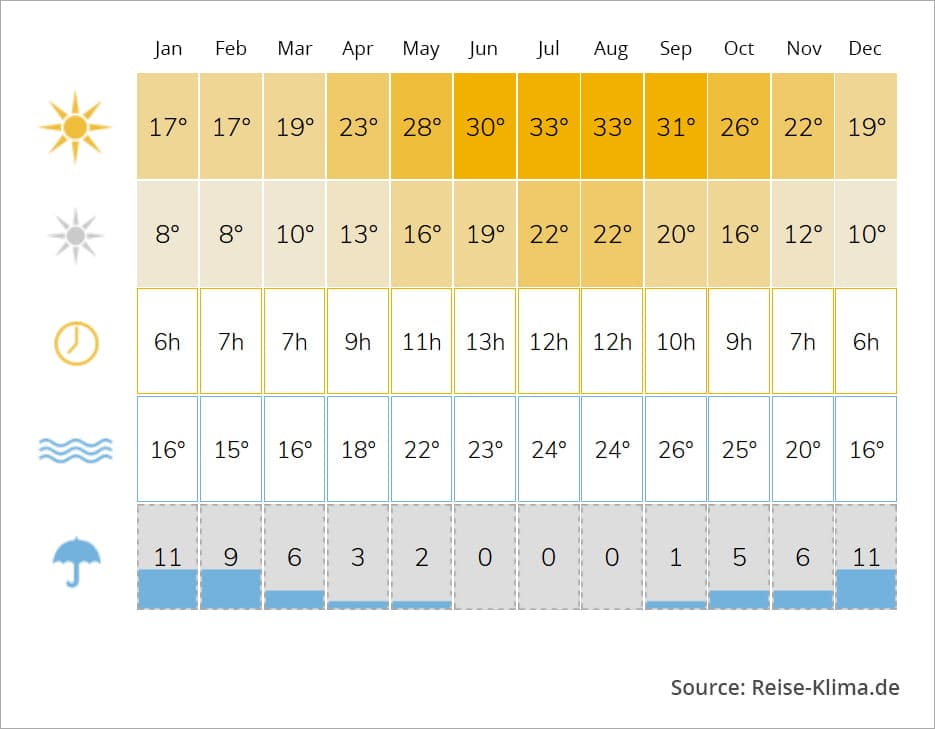

If you compare this to other EU countries, such as Ireland or Cyprus (EU), and both of these are equally recognised states, you will see that that non-nationals are not liable for taxes on dividends, and that the corporate tax is only between 2,5% and 12,5%. This means that the overall taxation in other EU countries is actually much lower than in Estonia.

Take Away: The cheap and quick company formation procedure in Estonia is definitely promising at first glace. But from a tax perspective, there is unfortunately not a lot to be said for Estonia.

Online Bookkeeping and Tax Returns in Estonia

The online accounting software in Estonia, which appears simple and effective at first, is actually rather complicated.

In fact, it is just naivete and inexperience, which lets Digital Nomads believe that Estonia is an unbureaucratic country. The initial company formation may be simple enough, but the tax management and administration of an Estonian company is not so streamlined.

Certainly, the online system will save you 100-200 Euros per month, which you might usually spend on an accountant and tax advisor, so that they might help you with your bookkeeping, VAT declaration and financial statements.

But instead, you will be paying with your time. Lots and lots of your time. Just to keep up with the requirements of Estonia’s online accounting system, requires more than a couple of hours of work every month. Even proponents of Estonia, repeatedly point this out to foreign entrepreneurs.

Take Away: If time is money, I do not see Estonia’s online tax return system as an advantage. The whole point of the online system seems to be to limit bureaucracy. But this backfires when it results in individuals spending hours on their VAT declarations and financial statements. Especially when these individuals then do it without the support and advice of professionals.

The fact is that the online system does not end up saving anyone any money. Even if I invest 250.00 Euro per month in my accountant and tax advisor, this is probably comparably cheaper than the time it would take me to do it myself. And it must not be forgotten, that even if I do all my accounting in Estonia myself, I will still need a tax advisor in my country of residence to help me ensure that my income from Estonia is correctly incorporated into my financial statements there.

Note:

It is a myth that, by moving around and deregistering in your home country, you can live your life without being subject to taxation anywhere. This is a dangerous conclusion to draw. Find out why here.

Global Tax Transparency and Data Protection in Estonia

There is no data protection in Estonia. Or at least, there is not much understanding for it. The administration is completely centralised and every single transaction made by any (e-)resident are labelled with his or her personal ID number.

On top of this, entrepreneurs should be aware that Estonia has adopted both the CRS and EU-FATCA, meaning that your home country and its tax authority will be made aware of any business or personal bank accounts you hold in Estonia. The e-Residence does not offer any protection against these automatic information exchange protocols!

Take Away: You can only take advantage of low taxes, flexibility and discretion, if you actually relocate your tax residence from your home country to a tax-friendly country. The e-Residence Programme and online company set-up offered by Estonia does not constitute such a relocation.

The options which Estonia offers Digital Nomads are by no means bad. In fact, the simple and quick company set-up is actually a really interesting opportunity. Just keep in mind that Estonia does not provide solutions for the problems which Digital Nomads have always faced.

Important: only one of these criteria needs to be met, in order for a company to qualify as an "Active Company"!

Important: only one of these criteria needs to be met, in order for a company to qualify as an "Active Company"!